How to Get Dental Implants Covered by Insurance in Toronto

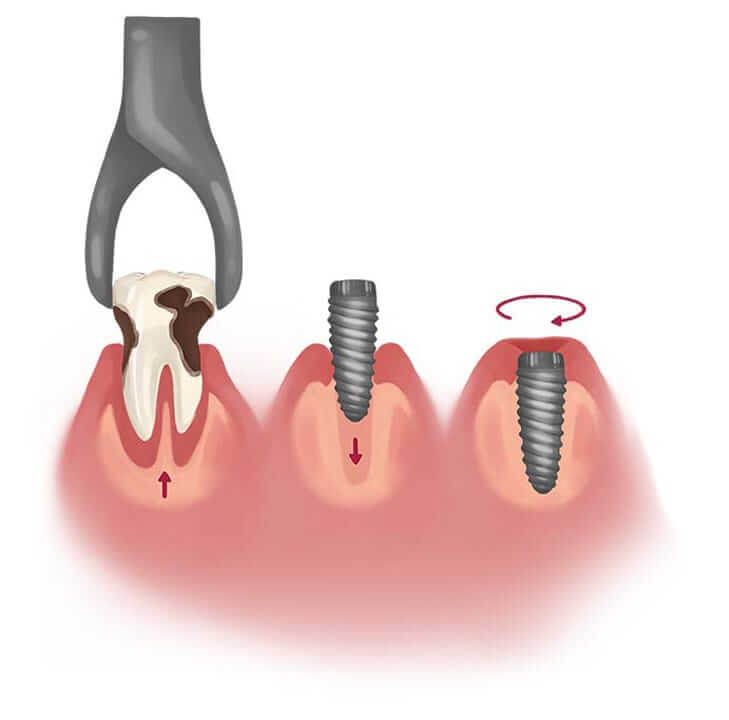

Dental implants have revolutionized dentistry, offering a durable and natural-looking solution for missing teeth. However, many patients are concerned about whether their dental implant will be covered by dental insurance.

Insurance coverage for dental implants varies significantly based on the specific policy and provider. Many Canadian insurance companies classify dental implants as cosmetic procedures, which means they are seen as being medically unnecessary and will not get covered. However, in some scenarios, a portion or all of the cost may be covered. It is crucial to review your policy or contact your contact your dentist to understand the specifics of your coverage.

Before inquiring with your dentist to find out if dental implants are covered by dental insurance, there are some things that you should know:

- Cost of Dental Implants

- Insurance Coverage For Dental Implants

- Factors Influencing Dental Insurance Coverage

- Steps To Maximize Insurance Coverage For Dental Implants

- List of Dental Insurance Providers in Canada

If you have any further questions about how to get your dental implants covered by insurance at Atlas Dental, please contact us.

Cost of Dental Implants

A cost of a basic Dental Implant can start from $4165, which includes the dental implant surgical placement, and the dental implant crown, plus any applicable material expense and dental lab fees. Zirconia (ceramic) dental implants cost slightly more. The codes relevant to dental implants in the Ontario Dental Association’s Suggested Fee Guide appear as follows:

Implants, Osseointegrated, Root Form, More than one component

- 79931 – Surgical Installation of Implant with Cover Screw – per implant: $1785+ Dental Materials Expense (approximately $350; for zirconia (ceramic) implants is approximately $450)

Crowns, Porcelain/Ceramic/Polymer Glass Fused to Metal

- 27215 – Crown, Porcelain/Ceramic/Polymer Glass Fused to Metal Base, Implant-Supported: $1280 + Dental Lab Fee + Dental Materials Expense (approximately $650-800)

Depending on your unique circumstance, implant surgery may be more expensive if any of the following is required:

- Tooth removal

- CBCT scanning

- Computer guided implant surgery

- Bone grafting

- Gum grafting

- Indirect sinus lifting

- Lateral window sinus lifting

Dental Implant services are usually considered a supplementary service by dental insurance plans and may or may not be covered by your dental insurance. Be sure to find out from your dental insurance plan provider how much you are eligible for before going ahead with dental treatment. Your dentist can help you submit an predetermination to your dental insurance.

Insurance Coverage For Dental Implants

Unfortunately, there is no universal answer to whether insurance will cover dental implants. Coverage depends on your specific plan, policy details, and exclusions. While some plans cover part of the cost, many impose restrictions or do not cover them at all. Coverage is typically offered by private insurers or employee benefit plans.

The Canadian government’s CDCP insurance administered by Sun Life does not cover dental implants, making private insurance the primary option for implant coverage. Understanding your policy’s terms and requirements is essential. Your dentist can assist in obtaining pre-approval and submitting necessary documentation.

Factors Influencing Dental Insurance Coverage

Several factors determine whether insurance will cover dental implants:

- Insurance Policy Terms: Review your policy for exclusions related to cosmetic procedures or specific clauses regarding implants. Some plans may offer partial coverage, while others exclude implants altogether.

- Pre-Existing Conditions: Some insurance plans impose waiting periods or exclude coverage for pre-existing conditions, such as missing teeth. If you lose a tooth, seek replacement as soon as possible to increase the likelihood of coverage.

- Medical Necessity Clauses: If tooth loss results from trauma, injury, or medical conditions, some insurance plans cover implants as a necessary restorative treatment rather than a cosmetic procedure. Examples include a car accident, sports injury, or workplace incident.

- Alternative Benefit Provision: Many plans apply a Least Expensive Alternative Treatment (LEAT) clause, meaning they will cover only the cost of a lower-priced alternative, such as a dental bridge, rather than a full implant. If a bridge costs $2,000 but an implant costs $4,000, insurance may only cover the $2,000, leaving you responsible for the remaining amount.

- Coordination with Medical Insurance: In cases involving severe trauma (jaw fractures, facial injuries), medical insurance (rather than dental insurance) may cover part of the cost. Extended health benefits or disability insurance may also contribute.

- Workers’ Compensation (WSIB in Ontario) – If tooth loss occurs due to a workplace accident, Workers’ Compensation may cover the cost instead of private dental insurance.

Steps to Maximize Insurance Coverage for Dental Implants

- Review Your Insurance Policy: Carefully examine coverage limitations, exclusions, and any preauthorization requirements for dental implants.

- Consult with Your Dentist: Your dentist can provide treatment plans, intraoral photographs, and x-rays that may support your claim for insurance coverage.

- Obtain Preauthorization: Some insurance plans require preauthorization for major procedures like dental implants. Submitting a request can clarify your coverage before treatment.

- Explore Alternative Financing Options: If insurance provides limited coverage, consider payment plans and other financing options.

At Atlas Dental, we aim to ensure that you receive the necessary dental care. We provide a transparent breakdown of costs and payment options so that you can make informed decisions about your treatment. Rest assured, there will be no unexpected charges. If you have additional questions about how to maximize your dental insurance coverage for dental implants, please contact us.

List of Dental Insurance Providers in Canada

If you are considering dental implants, you may want to check with the following major dental insurance providers in Canada to see if they offer any coverage for implants:

- Blue Cross Canada Dental Insurance

- Canada Life Dental Insurance

- Canada Protection Plan Dental Insurance

- Co-operators Dental Insurance

- Desjardins Dental Insurance

- Empire Life Dental Insurance

- Green Shield Canada Dental Insurance

- GroupHEALTH Dental Insurance

- Industrial Alliance Dental Insurance

- Manulife Dental Insurance

- Medavie Blue Cross Dental Insurance

- SSQ Dental Insurance

- Sun Life Dental Insurance

Since coverage varies by plan, it’s always best to contact your provider directly or consult with your dentist to determine eligibility for dental implant benefits. If you have additional questions about how to maximize your dental insurance coverage for dental implants, please contact us.